In the last post, I went into the 12 reasons why startups fail based on a CB insights article. With the result that most of the 12 reasons are not caused by external factors but mostly by the founding team.

Nobody is perfect and therefore the founding team should unabashedly access the experience and help of their investors. With this extended team, many of the problems can be corrected at the beginning and a personal disaster can be prevented.

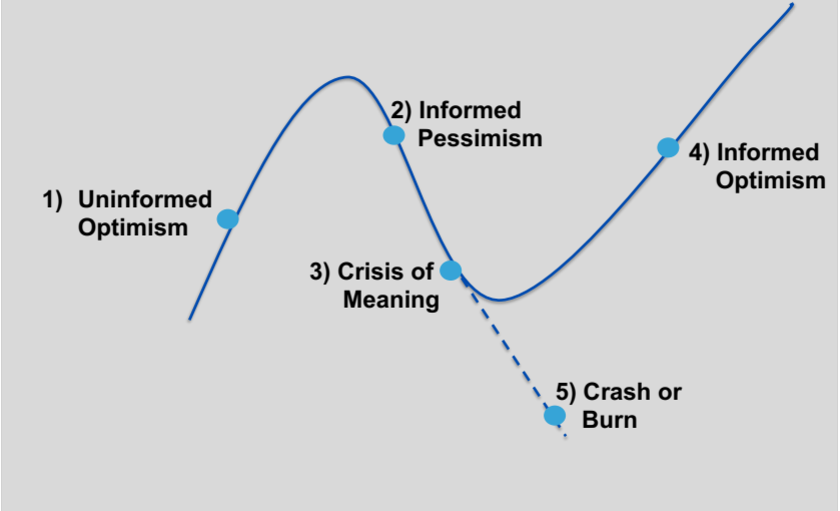

But let’s take a look at the typical mood of a founding team.

First, ideas are developed for a problem that promises a certain growth potential. The decision is made to found a startup and collect investor funds.

(Freely interpreted in accordance with Kelley / Connor “Emotional Cycle of Change”)

Here, the founding team is in the “uninformed optimist” phase. I find this designation very apt, because if you’d already know all the hurdles and difficulties until the solution (Technical Proof, Product-Market fit, ongoing fundraising pressure…), most startups would never be founded in the first place.

Now, when difficulties arise and it becomes clear that some of the assumptions made do not apply, and that there are no easy solutions, the founding team enters the “informed pessimism” phase.

Depending on the extent of the problems and, in most cases, the need for capital, a high level of pressure is created within the team. The team members deal with this differently and it can lead to discord and separations in the team.

This point is shown in the graphic as the “crash” point.

Mostly, only the strong belief that a solution can be found to avoid a crash helps here. When a solution is found the team emerges stronger. By solution, I don’t mean simply collecting new money from investors. This is simply buying time, which can also help, but only if there are proposed solutions. Now the phase of “informed optimism” has been reached. In this phase, you now know the problems as well as the solutions to them.

The result might be a new product design, a new business model or focusing on another market segment.

Hopefully the financial business case and potential are still attractive to investors. Only then will they stick with it and continue to fund the startup.

If some investors do not want to invest now, feedback should be sought. It is important to understand whether some investors do not invest because the case does not fit their investment thesis or whether this is a case of “informed pessimism“.